Elder Publisher

This post get consist of associate hyperlinks. Which means that we possibly may secure a payment if you decide to buy something by way of the backlinks. Delight realize our very own revelation for more information.

After you make an application for a home loan, the lending company will need paperwork to ensure the job. This new models you’ll need getting a home loan dependent on their type of state. Including, a self-employed person will need to complete various forms than men doing work for a firm.

Centered on your financial situation, you will find eight mortgage records that you may want to submit when obtaining a mortgage.

step one. Taxation statements

The loan financial need to know the complete picture of your financial condition. They most likely need you to indication a questionnaire 4506-T. It allows the lender so you can consult an income tax come back content off brand new Irs.

Extremely loan providers wanted one or more otherwise a few years’ tax statements. Such make sure your annual money try similar to the repayments you claimed on the shell out stubs. Plus, there must not be big annual action

2. Pay Stubs, W-2s, or any other Earnings Proof

The lender can get consult the latest spend stubs that you have obtained in the last times. Tax statements let them have a concept of your current economic reputation, and you may shell out stubs can help to evaluate your money.

While you are worry about-working otherwise has actually almost every other earnings provide, you might have to establish your lender’s legitimacy thru 10-99-models, lead deposit, or any other procedures.

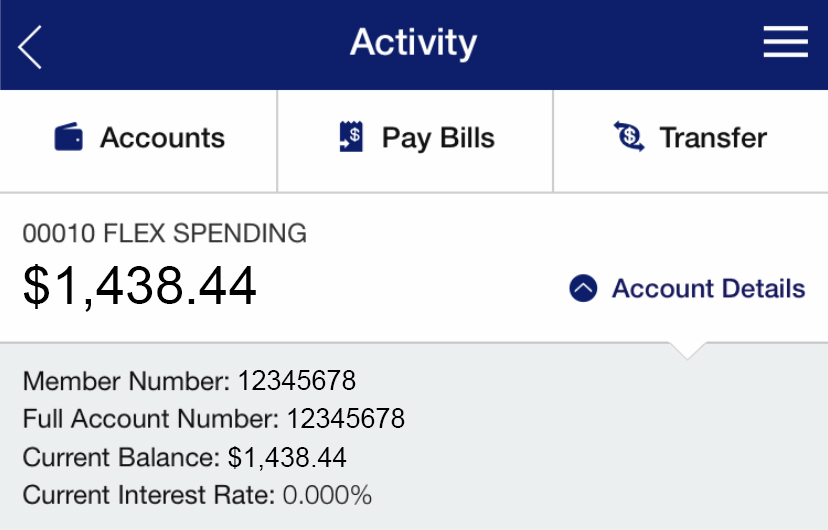

step 3. Asset and you can Bank Comments

When you’re assessing your chance, lenders looks at the bank account or other property. It could tend to be their expenditures and you may insurance coverage, particularly coverage.

The lenders usually wanted these types of records to ensure that you possess a number of months’ property value financial reserves on your account within the the function away from an urgent situation. They will certainly together with verify that your own down payment was a student in your savings account for some weeks and did not arrive overnight.

4. Credit score

To check on you just like the that loan candidate, lenders can look enhance credit rating with your written otherwise spoken concur. You may need to establish any inconsistencies in your credit score.

It could be wise to have been happy to build good declaration detailing negative circumstances on your credit history. It will help the lender determine the risk level. The financial institution could possibly get evaluate facts which might be inevitable having a short go out in different ways from the usual delinquency.

5. Current Characters

Your friends and relatives can get assist you in buying a home through providing you currency. If this is the case, you’ll want to commercially concur that the cash are a bona fide current and not financing.

This new documents is discuss the relationship within individual who are gifting and you, as well as the real level of the present.

six. Pictures ID

You will probably need certainly to present a photograph ID, instance a license. It is simply to prove that you will be whom you allege becoming.

7. History of Renting

When you are a buyer who cannot individual property at expose, many loan providers will require evidence that you can pay timely. They might consult an entire fast loan same day deposit year’s property value canceled rental cheques that your property owner has actually cashed.

They could and additionally pose a question to your property manager add research that you have made your book payments in the long run. Their rental record is especially important if you don’t have an excellent extended credit record.

Latest Phrase

The desired data files to submit the mortgage demand are the new exact same for everyone banks or other credit establishments. Certain specific criteria you certainly will differ from financial to bank.

The latest files you’ll need for a home loan also can are very different dependent on the loan package, the kind of one’s loan, the borrowing profile, etc. To own flexible funds, you can even consider using a mortgage loans borrowing union.

Aidan has been making reference to private financing for more than six ages. Before, he did because a corporate Financing Analyst where the guy dedicated to Homework, Team Valuations and. He or she is a good CFA charterholder.