An identical process is followed if the bonds are issued at a discount as the following example shows. The first includes when companies charge a higher price for their issued bonds. Some issuers charge higher or lower to issue a bond based on several factors. As mentioned, every bond has a face value, which dictates its coupon payments and obligation. However, it does not represent the price that the bondholder will pay for it.

The most famous types of bond issues are the United States Treasury Bills (or T-Bills) and the British Gilts issued by HM Treasury Debt Management Office. This entry records $5,000 received for the accrued interest as a debit to Cash and a credit to Bond Interest Payable. The systematic reduction of a loan’s principal balance through equal payment how to calculate premium on bonds payable amounts which cover interest and principal repayment. The journal entries for the years 2024 through 2027 will be similar if all of the bonds remain outstanding. Usually, these instruments trade at a higher or lower value than their face value. Similarly, the issuer must also calculate the present value of this payment based on the market value.

Unamortized Bond Premium: What it Means, How it Works, Example

This is true, but the effective interest method, as the name suggests, provides a more “true” disclosure of the interest burden ABC is committed to each year when compared to the straight-line method. It achieves this through reflecting the fact that the longer this debt is held the greater the impact the premium has on ABC’s financing costs; just as a discount has the opposite impact. For the financial year ended say March 31 for ABC, assuming no other interest entries or adjustments, we would see in the profit and loss statement a net interest expense of $47,337 ($60,900 – $13,563). And for the end of the following financial year we would see a net interest expense of $94,675 ($121,800 – $27,125).

Once you understand the calculations involved and why the method is used, it becomes much simpler to implement and a lot less daunting the next time you face applying it. Set out below is the calculation required to work out what the effective interest expense is for ABC Ltd for each interest payment period. Below the table in the notes there is a explanation of what each column does. Bonds are best known as being issued by companies and central governments, however, not-for-profit organisations also use them for their debt funding requirements.

How to Calculate Bond Premium or Discount? (Explained)

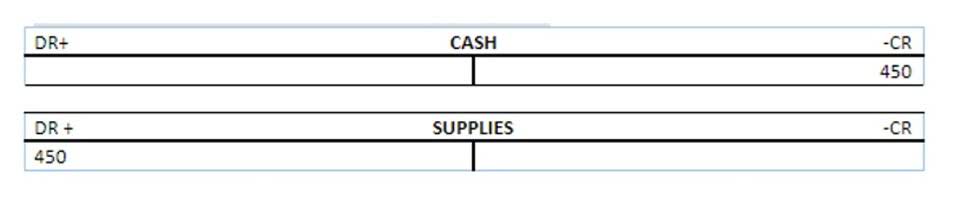

Whereas the discount on a bond is recorded as additional interest expense, the premium on a bond is recorded as a reduction in interest expense. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. The journal entries for the remaining years will be similar if all of the bonds remain outstanding. Don’t be put off by the work involved in the effective interest method.

Use our tax on savings interest calculator to see how much you will pay – The Telegraph

Use our tax on savings interest calculator to see how much you will pay.

Posted: Sat, 06 Apr 2024 07:00:00 GMT [source]

During this period, they receive interest payments based on face value. The following table summarizes the effect of the change in the market interest rate on an existing $100,000 bond with a stated interest rate of 9% and maturing in 5 years. If a bond is issued at a given rate and then prevailing interest rates in the bond market fall, then the higher-interest bond looks better than it did previously.